Aegean Marine Petroleum (ANW) offers an interesting twist on the shipping sector. The big story in shipping for several quarters has been the looming supply of new ships ordered during better economic times prior to the credit crisis. The three commercial freight sectors of dry bulk, containers and tankers are all suffering from depressed daily rates as fleet capacity continues to grow faster than demand. We have selective investments in two companies that we believe are well managed, have low levels of debt and trade at a substantial discount to tangible value - they are Overseas Shipholding (OSG) and Euroseas (ESEA) - but a pickup in rates does not appear imminent.

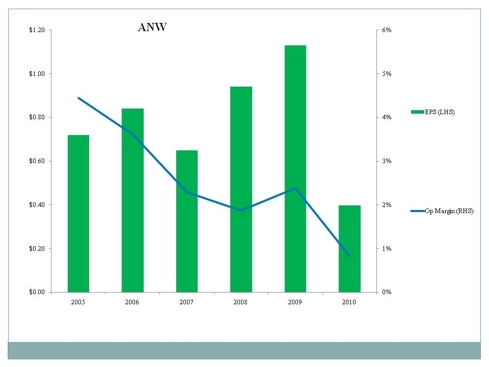

ANW provides bunker fuel to the shipping industry. We liked the complimentary business model ? at a time when fleet capacity is expanding, providing fuel looks analogous to selling gold miners pick axes. There does not appear to be a large supply of refueling ships on the horizon, so the outlook for this segment of the industry is somewhat more promising. However, ANW?s stock has been weak recently, which caused us to take a closer look. Its recent 4Q10 earnings were disappointing (in fact the company pre-announced, the results being so different from expectations). The company buys bunker fuel and sells it on for a slim margin, so its key metrics include the margins at which it operates. The pricing pressure customers are experiencing has been passed through to ANW, and as a result its operating margins and profit have suffered. Its gross spread per metric ton of marine fuel sold fell from $28 in 2009 to $21 last year. The company has responded by transferring ships from more competitive markets (such as Singapore) to others where it can operate more profitably.

The question is whether the depressed margins they have been experiencing represent a temporary condition, or will become a permanent feature of the business model. Because the glut of new capacity in shipping doesn?t apply in the same way to the refueling fleet, we think current valuation represents an attractive investment opportunity.

The company has relatively low debt, and is trading at a discount to tangible book value (though that is true of many shipping stocks). Revenues are expected to reach $6.5 billion in 2011, up 30% from 2010. A 1% increase in operating margin to 1.8% would generate EPS of $2.10. We won?t know for another quarter or two if the margin pressure will abate somewhat, but we think at current levels the stock represents an attractive risk/reward.

Click to enlarge

Disclosure: I am long OSG, ESEA, ANW.

Powered By iWebRSS.com